Title: Reallocating emissions from current V1 farms to DAO in anticipation of new bridges

Author(s): H. Barbara (and looking for cosigners and cosponsors)

SaucerSwap Voting Interface: [N/A]

Related Discussions: [N/A]

Submission Date for RFC: [2024 September 29]

A Preface

...

I do apologize if I ramble a lot. If my fluency of language was described as viscosity of a liquid, it would be pitch drop. But the purpose of the RFC is to open up to comments. Critique and criticism are appreciated to help make this potential proposal the best version of itself.

Additional, this is a very very long read, broken up into sections. This is mainly to serve not only as a pitch, but an annotated guideline to help serve inspiration for other future proposals. Having a bunch of ideas in which proposers can take bits and pieces from and adding their own justifications for their own proposals.

Introduction

I propose the first of a two step proposal to first redirect some of the emissions from V1 farms to the DAO treasury in anticipation of new bridges. These emissions would help increase the longevity of the DAO treasury. Then reallocate some or all the emissions to these new pools once bridges are formed and bridged assets are in established pools with liquidity and interest.

Background

The proposal is two fold, addressing two different things. DAO treasury and attracting liquidity to the network.

Longevity of the DAO treasury

Recent proposal submitted by @Larry about strengthen development funds did get me inspired to do the same for the DAO funds. Help increase the longevity of the fund with some increase emissions taken from underperforming farms. Whether or not all or some of the reallocated emissions goes to the LPs with bridged assets can be discussed in the second phase once LPs are established.

Attracting liquidity to the network

One of the main issues of Hedera DeFi is the lack of liquidity on the network. There could be many reasons for it, whether it be bridges, certain technical limitations that hinder certain DApps being built that engage users, etc.

But I will focus on bridges. Bridges will help ease friction point between networks to incentive liquidity to move from one network from another. While HashPort is one bridge that does connect to Hedera, other networks have multiple bridges, even multiple that connect to the same networks. With liquidity, comes developers interest to built DApps, and with interesting DApps comes users liquidity in an positive feedback cycle.

Between the SaucerSwap core team mentioning in their September Development Update about working with “two major bridge partners to unlock the next phase of liquidity and user inflow to Hedera,” and HBAR Foundation quote tweeting Axelar, I do expect bridges to come live relatively soon.

SaucerSwap, in their part, and help attract liquidity to the network via farm incentives.

Rational

The rational of making this one of a two-part proposal is that we don’t know which which pools will be created once bridges becomes live. However, we can reallocate emissions from underperforming pools now to the DAO treasury. Then move the emissions weights to new pools with bridged assets.

Benefits to the DAO and ecosystem

Expanded Ecosystem Resources

Similar to this proposal, redirecting emissions provides SaucerSwap DAO with additional resources to be able to provide liquidity or funds to other DApps (for example, liquidity provisioning for lending and borrowing protocols , or for the SaucerSwap platform itself (ideas include creating a perpetuals platform, or a maybe using funds to extend farming rewards beyond the end of minting of SAUCE).

Aligned Incentives

Adjusting the reward structure encourages users to participate in activities that genuinely contribute to the protocol’s growth, such as providing liquidity to pools that facilitate higher trading volumes.

Downsides

Reduced emissions to the LPs that were cut might lead to liquidity shifting away from those LPs

A decrease in incentives for certain pools might lead to a negative impact on its liquidity.

Unknown wait time between bridges being connected to liquidity being bridged to the Hedera network and SaucerSwap

This could happen immediately, or we could end up waiting for a long time for liquidity to actually come to the network. Still, it’s part of the reason why I would want emissions to go to the DAO treasury while we wait to increase the treasury longevity.

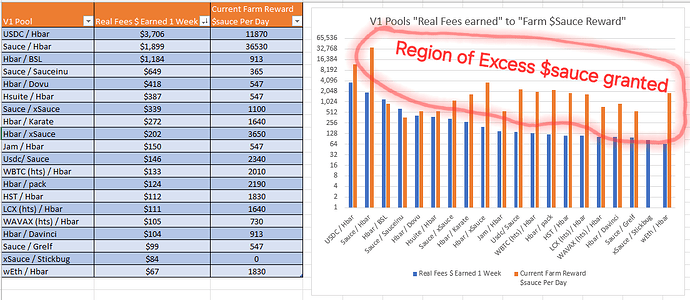

Technical details of emissions weights changes

Having discuss with a few people, we have agreed to the general principles of cuts should not be based on favoritism, but rather by performance metrics that could apply to any pool. Two metrics inspired from the conversations in this proposal.

Liquidity to emissions ratio ...

Farm rewards incentivize staking liquidity into a pool. But if a pool with a given emissions rate is not performing as well as other pools of comparative weight, it is not an effective use of the emissions to incentivize TVL.

This is also relate to rewards APR being relatively high since liquidity is relatively low to the emissions rate.

Reducing emissions to LPs with farms with high Rewards APR ...

Using farm rewards for new pools can help bootstrap LP rewards and incentivize users to stake liquidity into the pool. However, if the LPs rewards are solely being maintained by rewards, then they may become unsustainable over time, leading to a reliance on continuous incentives rather than organic liquidity growth. To create a healthy and resilient ecosystem, it’s crucial to balance reward mechanisms with factors that foster long-term user engagement, such as improved platform utility, governance participation, or innovative features that enhance the overall value proposition of the platform.

The way discussed in the previous linked proposal was to take the liquidity weighted-average total APR (APR from trading fees and other rewards mechanisms) and making cuts based on the rewards APR. For an example: if the LWA APR in 10% but if LP A-B rewards APR was 20%, it indicates the LP is been way too sustained by rewards APR and a 1/2 cut to emissions rate would be justified.

A new metric that was inspired by the SaucerSwap core team proposal is based on fees APR of a LP. I do know the team’s proposal was more directly related to comparing ratio of the LP TVL to the platform’s TVL and the trading volume ratio’s, but I do think comparing fees APR is a good proxy.

Emissions cuts based on very low fees APR ...

As mentioned in SaucerSwap Core team’s proposal, “excessive rewards for low-risk, low value activities can distort the market and undermine the effectiveness of the incentive structure designed to promote meaningful participation.”

The way I was theory-crafting a cut like this was based on Liquidity-weighted average fees APR and how much the LP underperforms by. Ideally, it would not but be based on a 1 to 1 cut (e.g. 10% underperformance results in 1/10 emissions cut) but rather have a cubic relation. Note: cubing a number less than 1 makes the results smaller. So while a 10% underperformance might justify a 0.10 x 0.10 x 0.10 = 0.001 cut to emissions (or so negligible that it’s not even worth doing based on this metric), a LP fees APR that’s underperforming by 50% might see a 1/8 cut to emissions, underperforming by 75% might see a 42/100 cut to emissions. In the example of HBAR/HBARx V1, their fees APR was underperforming compared to other V1 LPs with emissions by 99%.

If there’s other metrics to consider, do mention them for consideration.

Edit:

The ratio of Trading fees generated to amount of rewards given to a LP

This has been inspired by the comments further down here.

The easier way of calculating this is Trading Fees APR/ Rewards APR.

It would be the same as (Trading volume / Liquidity) / (total emissions / liquidity) which equals Trading volume / total emissions.

The justification being we would like to reward pools that generate a lot of fees relative to the amount of liquidity it has. I do acknowledge low liquidity pools can easier manipulate the data, but we generally have not given emissions to LPs with little liquidity to begin with. Either way, the trading fees would slowly burn out any inorganic trading volume as a self-correcting measure.

Now, there’s isn’t some mathematical formula to take these metrics or any other metrics and spit out a number, but these metrics can serve as a basis for justifying changes to emissions weights. And when it comes to the actual proposal, a lot of the explanations will be cut and just a list of LPs, metrics, and cuts proposals for each. For this RFC, I will be linking to comments in this post as the data changes daily, but for a potential example of what cuts could look like, I’ll have a comment out on the 30th with a bunch of charts like this one.

Link to current metrics and proposed changes here

[HERE]

Current Limitations of the RFC

Manual data entry means I've been limited in comparisons of LPs with emissions...

I do have to manually enter the data into spreadsheets to get some calculations. I do hope there could be some way to automate getting data like this. Maybe an API into a Google sheet. If I could do that, I could have data for more than just LPs with emissions, but comparing to LPs even without emissions. having data archived automatically like that would benefit the whole community as proposers and community overall can have more insight on comparisons. It would be very interesting to see if a certain LP trading fees that receive emissions are under performing against an LP that doesn’t receive trading fees.

Outdated emissions weight data in the SaucerSwap docs...

Currently the V1 farm weights page is outdated. HBAR/WBNB[hts] V1 is not receiving farm rewards according to the SaucerSwap DEX UI. If weights are different than what is entail, than some of the Liquidity weighted average data would be inaccurate as well. Or more importantly, moving emissions weight around might not get the expect results like not getting the right amount of SAUCE per minute directed to a new pool because the emissions weight from one of the pools ended up being lower than previously documented.

I do wish the emissions tables also have a column for weights number as described in core team’s proposal. And since the Core team’s proposal is moving emissions weight from V1 farms to dev accounts, I do wish the new emissions table include lines for all the accounts (E.g. core development, marketing, operations …). Whether or not proposals do pop up in the future to move emissions to these accounts, having the knowledge and option to do so is nice.

Also, I does suppose someone can take the time to help teach us how to read on-chain data. That way, we can verify the accuracy of docs.

Voting options

-

FOR: reallocate V1 farm emissions from underperforming LPs to the DAO treasury. Once new bridges are formed and healthy LPs with bridged assets are formed, a new RFC is to be created discussing incentivizing these pools.

-

AGAINST: No changes to the V1 farms emissions weights.

Final Remarks

Yes, the RFC is about DAO treasury and incentivizing pools with bridged assets from upcoming bridges. But this exercise also serves other purposes.

Gauging Community interests in discussing emissions changes

As much as I do love @Larry, governance would be less a DAO and more an opinion poll if the only proposals that garner significant interest, whether in discussion or in vote participation, are the ones from the Core team.

Engaging communities for networking and giving them an opportunity to establish themselves as group worth appealing to for proposals

Making a proposal about the DAO treasury and opening up to cosponsors gives individual community members or even groups of people a chance to make their presence known for governance purposes. Yes, I did reach out to a few people or groups and few reach back to me. None of them has read this RFC in full prior to this submission, but I did give general guidelines on the purpose and the metrics used justified certain changes. So while they are still free to cosign, the floor is open to other groups or people.

Whether or not they end up cosigning, or even end up disagree with this particular RFC/proposal, it’s still good for them to have their opinions publicly known. That way, future proposal submitters can see these groups/people are worth outreaching to for support.

Building goodwill and increase engagement from others to prevent poison pills proposals from passing

It would be to the benefit of the platform and the community to prevent malicious actors to take control and pass poison pills. And example of this is the Build Finance DAO treasury getting drained when a malicious actor accumulated enough voting power and there wasn’t no time for countervotes to prevent it.

I don’t expect everyone to keep an eye out for proposals all the time, but if a few people that do keep a lookout are able to notify large groups of people quickly, a countervote could be quickly rallied to prevent malicious proposals to pass. We shouldn’t rely solely on the quorum threshold to prevent malicious proposals.

So regardless if this proposal passes, I would consider it a victory if there’s increased community engagement for the reasons stated above.